Digital Banking

- Home

- Our Services

- Digital Banking

Benefits of Digital Banking

Advancing to a more technologically sophisticated way of doing things, it goes without saying that the benefits long outweigh the costs. Similarly, digital banking as a technological by-product aims to make life easier for the customers of a bank. Digital banking has the following benefits:

- Digital banking enables consumers to perform banking functions from the comfort of their homes, be it an elderly person who is tired of waiting in lines or a working-class professional who is caught up with work, or a regular person who does not want to visit the bank’s branch to run a single errand. It also offers convenience.

- Elaborating on the convenience offered, digital banking lets a user carry out banking work around the clock, with 24*7 availability of accessto banking functions.

- One of the biggest drawbacks of traditional banking was the overly placed importance on paper. Banking has become paperlesswith the development of digital banking as a service. A user can log into their account at any point in time to monitor records.

- Digital banking allows a user to set up automatic paymentsfor regular utility bills such as electricity, gas, phone, and credit cards. The customer no longer has to make a conscious effort of remembering the due dates. The customer can opt for alerts on upcoming payments and outstanding dues.

- Online shopping has become a cakewalk with payment channels becoming well-integrated with the online shopping portals. Internet banking has significantly contributed to online payments.

- Digital banking extending services to remote areasis seemingly a step toward holistic development. With smartphones at affordable prices and internet access in remote areas, the rural population can make the most out of digital banking services.

- Digital banking-enabled fund transfers reduce the risk of counterfeit currency.

- With the help of digital banking, a user can report and block misplaced credit cards at the click of a button. This benefit greatly strengthens the privacyand security available to a bank’s customer.

- By promoting a cashless society, digital banking restricts the circulation of black moneyas the Government can keep a track of fund movements. In the long run, digital banking is expected to lower the minting demands of a currency.

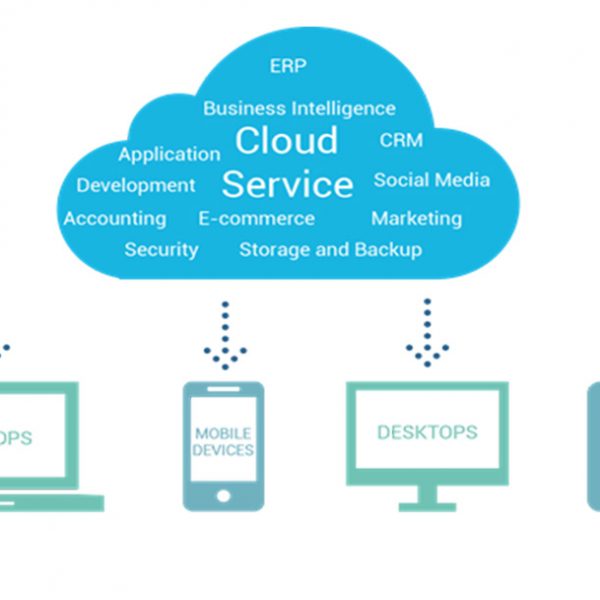

Digital Product services

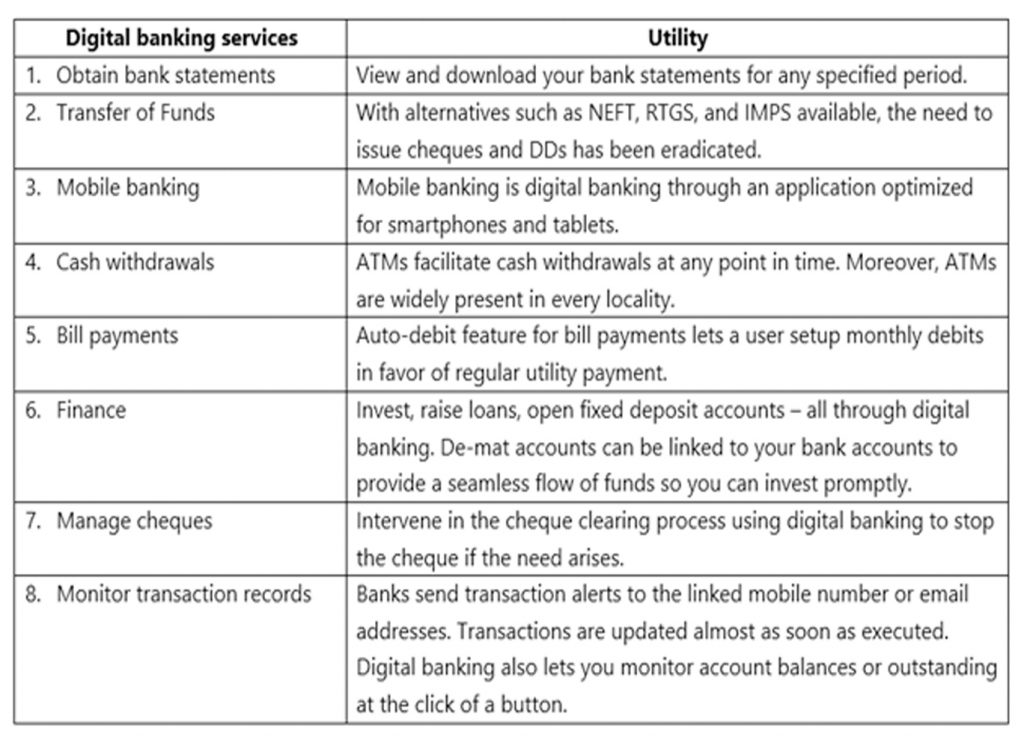

If an individual has access to a stable internet connection and an internet-enabled smart device, digital banking has a lot to offer.

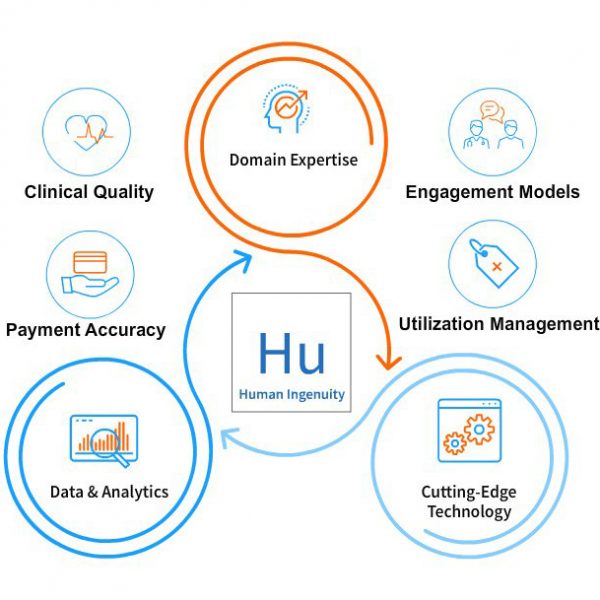

We’re not just protecting users, customers, and patients. We’re protecting your business as well.

Types of Digital banking payments

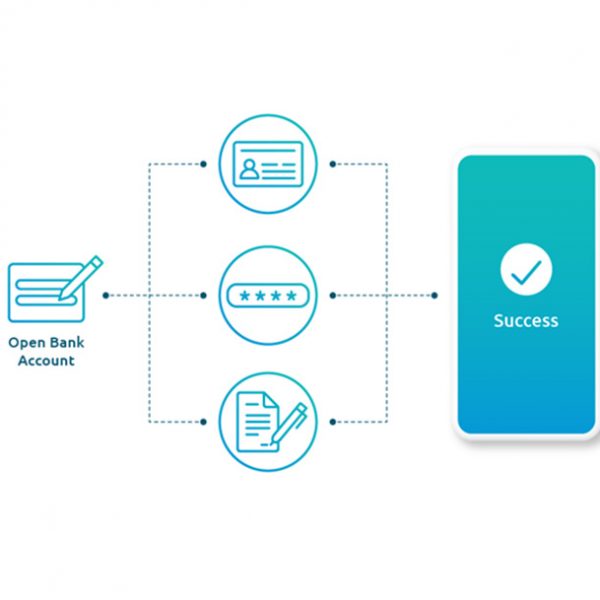

- Banking cards:Cards are not only used to withdraw cash but also enable other forms of digital payment. Cards can be used for online transactions and on Point of Sale (PoS) machines. Prepaid cards can also be issued by the banks; such cards are not linked to the bank account but function through the money loaded onto them.

- Unstructured Supplementary Service Data (USSD): By dialing the number *99#, mobile transactions can be carried out without an application and internet connection. The number holds nationwide applicability and promotes greater financial inclusion on the ground level. The service lets the caller surf through an interactive voice menu and chooses the desired option on the mobile screen. The only catch is the mobile number of the caller should be the one linked to the particular bank account.

- Aadhaar Enabled Payment System (AEPS): AEPS lets the client initiate banking instructions following the successful verification of the Aadhaar number.

- Unified Payments Interface (UPI): UPI is the most trending form of digital banking presently. UPI makes use of a virtual payment address (VPA) so the user can transfer funds without entering bank account details or IFSC code. Another striking feature of UPI is that the applications let you consolidate all your bank accounts in one place. Funds can be transferred and received around the clock with no time restrictions. UPI-based apps in India are BHIM, PhonePe, and Google Pay. BHIM application, in addition to the transfer of funds to other virtual addresses and bank accounts, also lets the user transfer funds to another Aadhaar number. More importantly, UPI-based payments are free of cost.

- Mobile Wallets:Mobile wallets have eliminated the need to remember four-digit card pins or enter CVV details or carry loose cash. Mobile wallets store bank account and card credentials to easily add funds to the wallet and make payments to other merchants with similar applications. Popular mobile wallets are Paytm, Freecharge, Mobiwik, etc. Mobile wallets, however, generally have a limit on how much can be deposited in the wallet. A small fee may also be charged on depositing the funds from the mobile wallet back into the bank account.

- PoS terminals:Typically, PoS machines are portable devices that read a card to authorize and complete the payment. Supermarkets and gas stations opt for this method of payment. However, with digital banking thriving, PoS terminals have evolved into more than physical PoS devices. Virtual and Mobile PoS terminals have surfaced, which makes use of the mobile phone’s NFC feature and web-based applications to initiate payment.

- Internet and Mobile Banking:Commonly known as e-banking, internet banking refers to obtaining certain banking services over the internet, such as fund transfers, and opening and closing accounts. Internet banking is a subset of digital banking because internet banking is only limited to core functions. Similarly, mobile banking is availing banking services through mobile-based applications.

Ready to see how Digital Banking can help?

Need a hand with your security program? Let our Digital Banking experts help.

Why is the digital banking website not working properly on a browser from my mobile device?

Our desktop digital banking site is not supported from mobile browsers. If you are using a mobile device, please download the ‘Range Bank’ app from the Apple App Store or Google Play Store to access your account information. The desktop digital banking site supports Microsoft Edge, Google Chrome, Firefox and Safari from a laptop or desktop PC.

Why am I receiving an error that I need to update my browser? Range Bank's desktop digital banking site supports the most-recent versions of

Range Bank's desktop digital banking site supports the most-recent versions of Google Chrome, Safari, and Microsoft Edge. You will receive that error message when attempting to login from Internet Explorer, or an outdated version of the browsers listed above.

How much transaction history will I see?

When you enroll in our digital banking platform, you will receive 120 days of history. Your history will continue to grow indefinitely.

Is there a way to show only my main account’s transactions in the ‘transaction card’ on my dashboard?

The transaction card shows the most recent transactions across all of your accounts. If there are accounts transactions you do not want to see within that card, you can choose not to show that account’s balance and activity, but it will still be available for transfers and bill payments. To hide an accounts balance and activity, follow the below steps:

- Choose the account

- Choose Settings

- Toggle the ‘Show balance and activity’ off for that account

What is a profile and how do I switch between them?

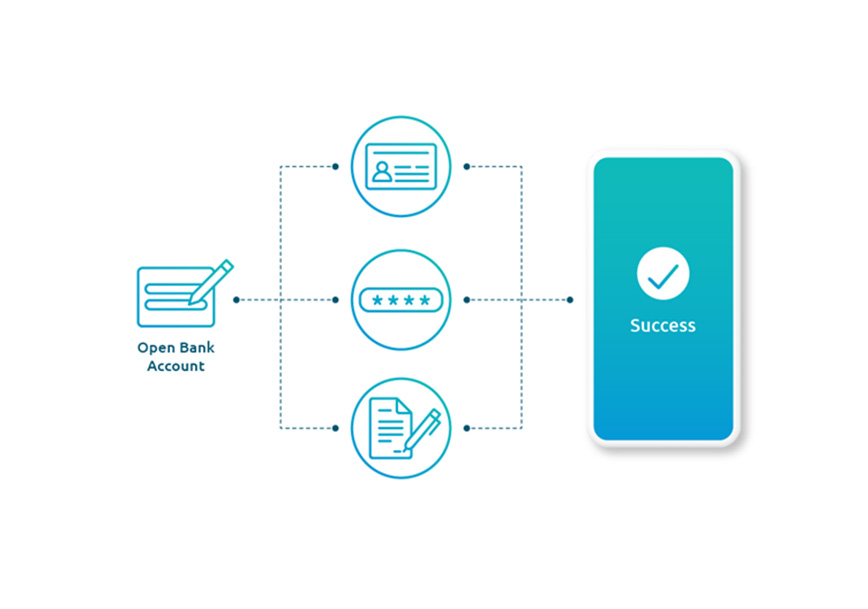

To add a new profile to the app:

- Click on the upper-left flyout menu

- Click on 'My Profile' towards the bottom of the screen

- Choose 'Add Profile'

- On the Add a Profile screen, choose 'Add Profile'

- You will then be prompted to enter your digital banking credentials, and complete two-factor authentication (if necessary

To switch profiles within the app:

- Click on the upper-left flyout menu

- Click on 'My Profile' towards the bottom of the screen

- Choose 'Switch users'

- Choose the profile you'd like to switch

- You will be prompted to enter your passcode or use biometric authentication if enabled

How does the low balance alert work?

If you’d like a low balance alert for an account, follow the below steps:

- Choose the account

- Choose Settings

- Toggle the ‘Low Balance alert’ on

- Type in the amount in the ‘Alert if below’ box

The alert will come through as a message on the desktop site or within the app, as well as a push notification on your mobile device if enabled.

How do I update the phone number associated with my digital banking account for two-factor authentication?

From the app:

- Click on the upper-left fly out menu

- Click on 'My Profile' at the bottom of the menu

- Choose Settings

- Choose Security

- Under Verification Options, click ‘Reset’ next to Two-factor authentication

From the desktop site:

- Click on your name at the bottom of the menu bar on the left-hand side

- Choose Settings

- Choose Security under User Management on the left

- Under Verification Options, click ‘Reset’ next to Two-factor authentication

This will walk you through the process of assigning a new phone number for two-factor authentication to your digital banking account.

How do I cancel a transfer I just initiated today?

Unfortunately, immediate transfers cannot be edited or canceled at this time.